net operating working capital definition

Net operating profit after tax NOPAT is a companys potential cash earnings if its capitalization were unleveraged that is if it had no debt. Net working capital current assets - accounts payable - expenses.

Working Capital Management Acca Global

Venture capital often abbreviated as VC is a form of private equity financing that is provided by venture capital firms or funds to startups early-stage and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth in terms of number of employees annual revenue scale of operations etc.

. Free cash flow FCF is the money a company has left over after paying its operating expenses OpEx and capital expenditures CapEx. Corporate finance for the pre-industrial world began to emerge in the Italian city-states and the low countries of Europe from the 15th century. Senate race border wall gets a makeover.

Our analysis of what to expect in the commercial real estate banking and capital markets insurance and investment management sectors in 2023and implications for the next decade. Operating cash flow indicates whether a company is able to. Operating Cash Flow - OCF.

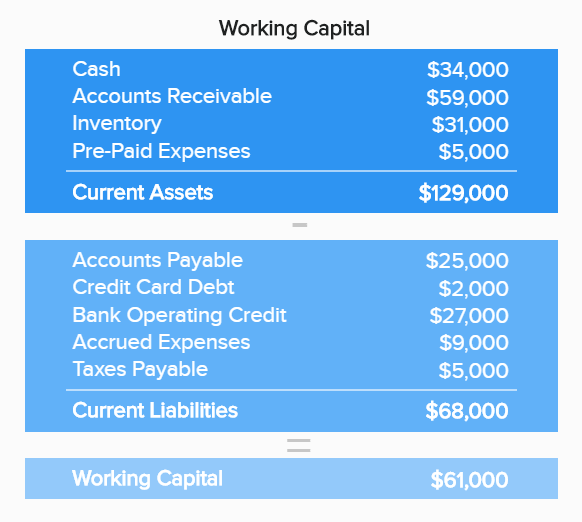

Net Working Capital refers to the difference between the current assets and the current liabilities of your business. A new operating model for work and the workforce. Net operating income equals all revenue from the property.

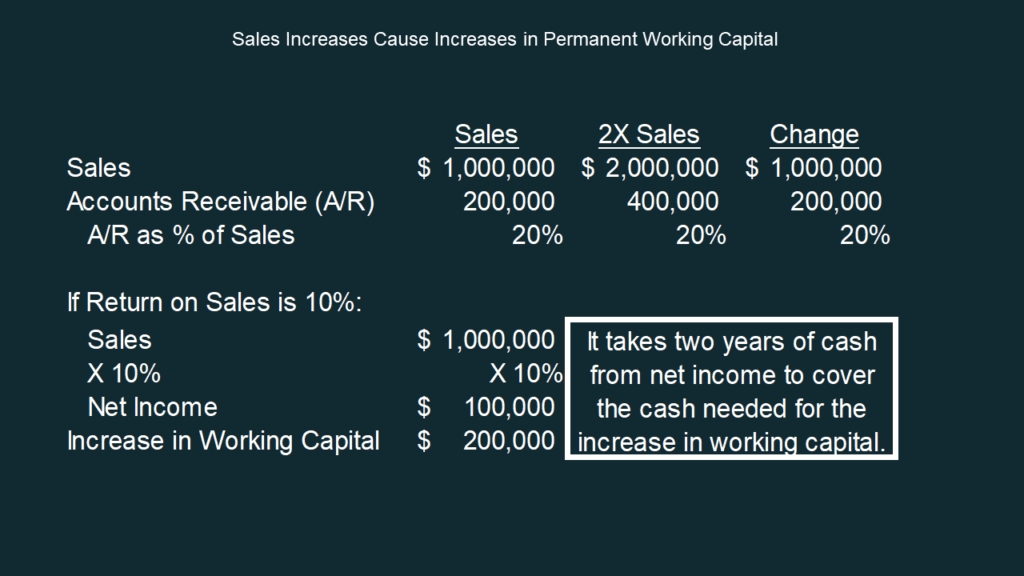

Working capital is a measure of both a companys efficiency and its short-term financial health. Companies that have a large amount of NOWC versus their liabilities and accruals demonstrate that they have the potential to grow over time and also make investments if necessary. Net income or net profit may be determined by subtracting all of a companys.

Venture capital firms or funds. Net Operating Profit After Tax - NOPAT. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. Newsroom Your destination for the latest Gartner news and announcements. NOPAT or Net Operating Profit after Tax is a profitability measure in which a companys profit is calculated excluding the effect of leverage by assuming that the company does not have any debt in its capital and in turn ignores the interest payments and the tax advantage which companies get by issuing debt in their capital.

Working capital is calculated as. The VOC was also the first recorded joint-stock company to get a fixed capital stock. Gross working capital is equal to current assets.

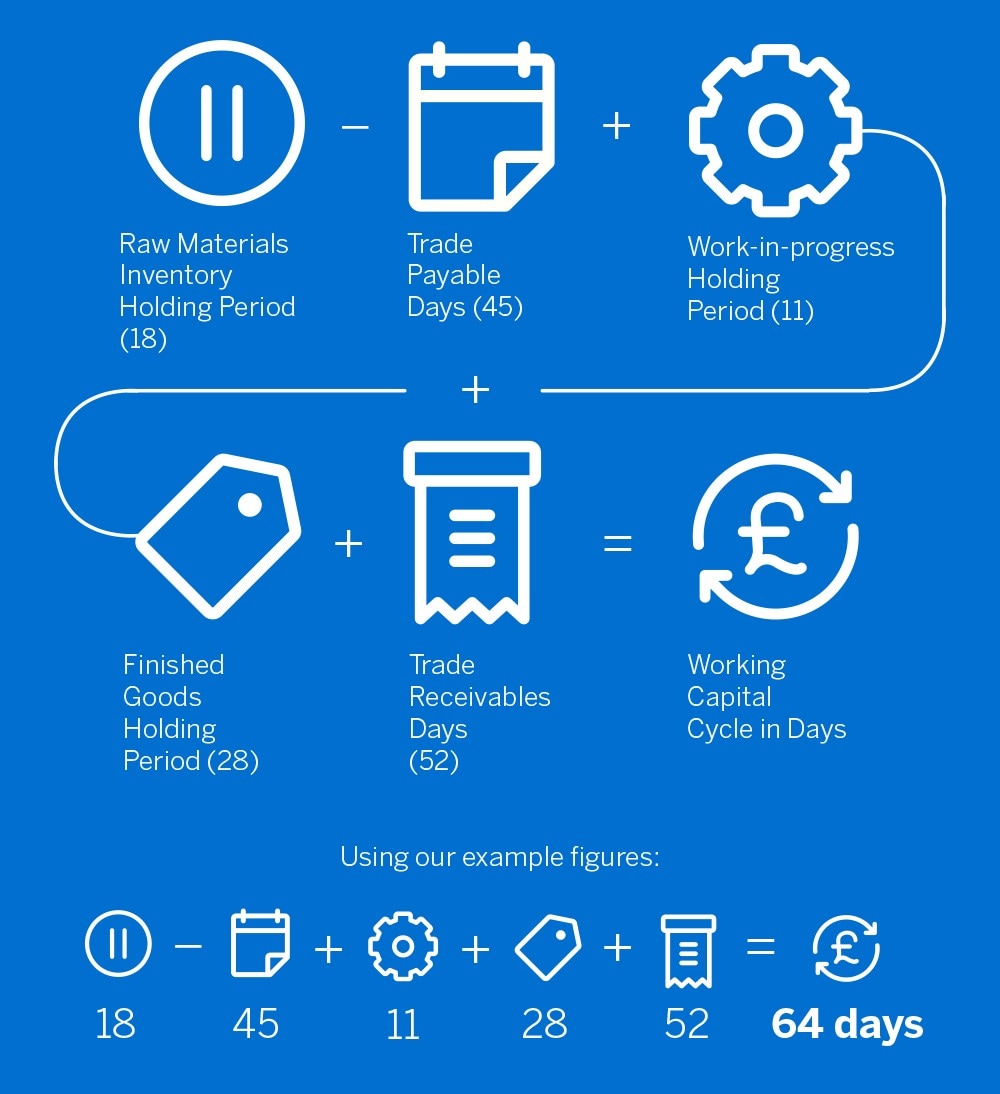

The more free cash flow a company has the more it can. ASCII characters only characters found on a standard US keyboard. Working capital management refers to a companys managerial accounting strategy designed to monitor and utilize the two components of working capital current assets and current liabilities to.

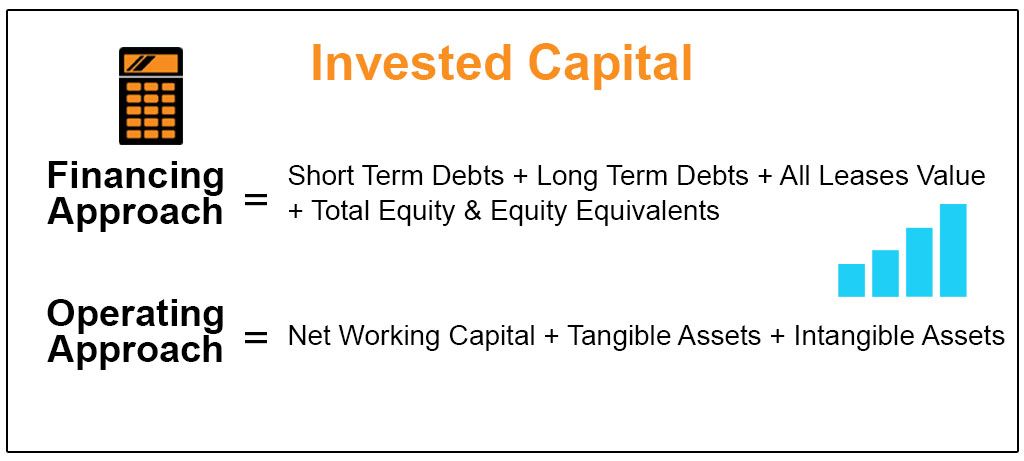

Net working capital also includes net operating working capital the difference between a companys current operating assets and operating liabilities. It is calculated by adding Net Working Capital minus Cash plus Fixed Assets which is the same as Net Debt Equity. The goal of working capital management is to ensure that a company can afford its day-to-day operating expenses while at the same time investing the companys assets in the most productive way.

Net working capital accounts. 6 to 30 characters long. Politics-Govt Just in time for US.

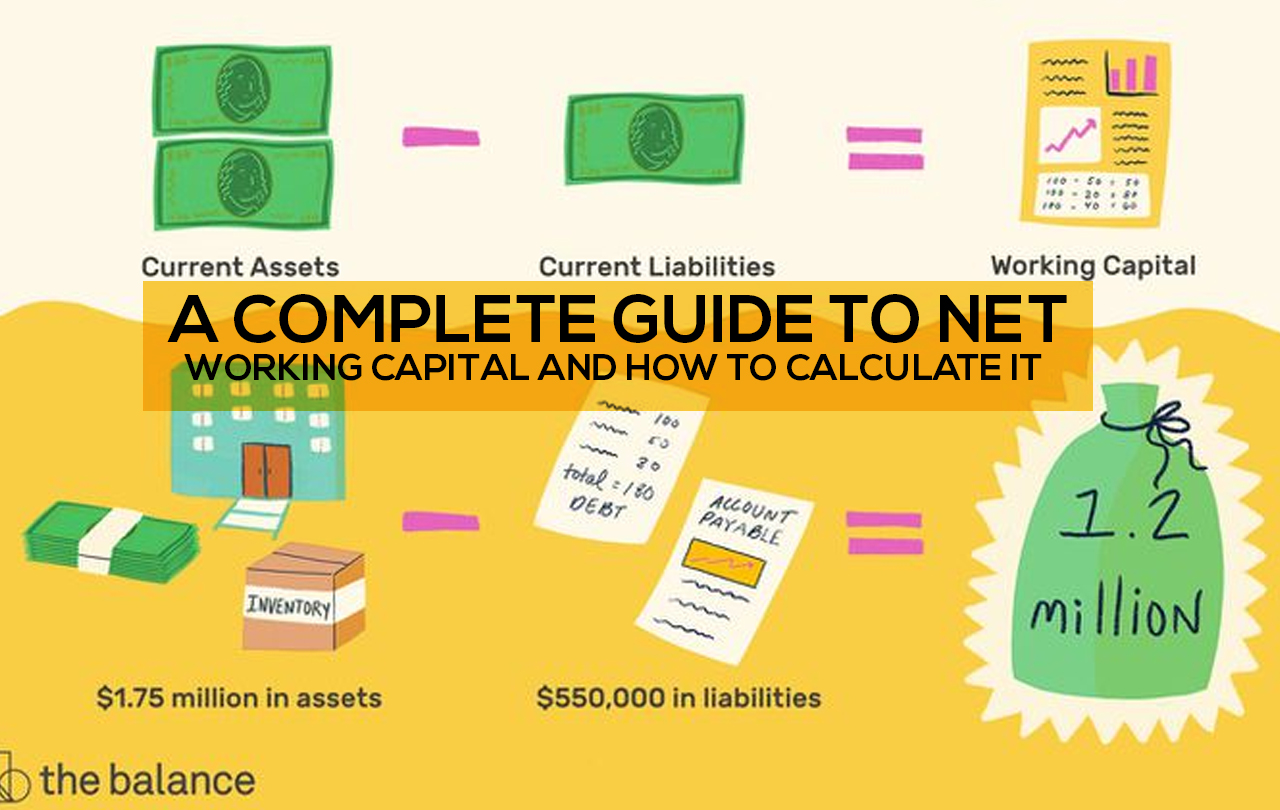

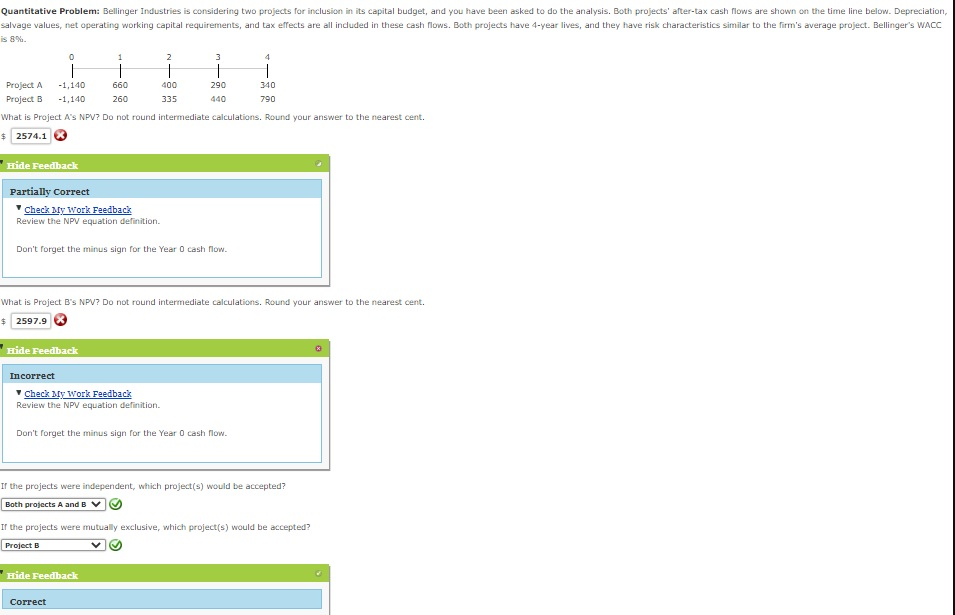

Formula Components and Limitations Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial. Business accountants calculate net and net operating working capital using the formula below. Net Operating Income - NOI.

Net Working Capital Current Assets Current Liabilities 49433M 43625M 5808 million. It not only affects the provision of risk capital but also hampers access to debt finance for certain SMEs. Net Operating Working Capital Operating Current Assets Operating Current Liabilities 30678M 34444M -3766 million.

Working capital management is a financial strategy that involves optimizing the use of working capital to meet day-to-day operating expenses while helping ensure the company invests. Profit margin is a profitability ratios calculated as net income divided by revenue or net profits divided by sales. The big and beautiful US-Mexico border wall that became a key campaign issue for Donald Trump is getting a makeover thanks to the Biden administration but a critic of the current president says dirty politics is behind the decision.

The financial ratio formulas are the following. Low working capital and low net operating working capital together with unfavorable current ratio quick ratio days sales in receivable and. The Dutch East India Company also known by the abbreviation VOC in Dutch was the first publicly listed company ever to pay regular dividends.

The return on capital employed is a more meaningful profitability ratio to assess business performance since it considers both the capital invested by shareholders and debtors. The road to net-zero emissions is not only a complex one but also. Must contain at least 4 different symbols.

Adequate Net Working Capital ensures that your business has a smooth. Working capital WC is a financial metric which represents operating liquidity available to a business organisation or other entity including governmental entities. An even narrower definition excludes most types of asset focusing only on accounts receivable accounts payable and inventory.

Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term. Net operating income NOI is a calculation used to analyze real estate investments that generate income.

It therefore presents that part of current assets that are financed using permanent capital like equity capital bank loans etc. The main source of market failure relevant to risk capital markets which particularly affects access to capital by SMEs and which may justify public intervention relates to imperfect or asymmetric information.

Changes In Net Working Capital All You Need To Know

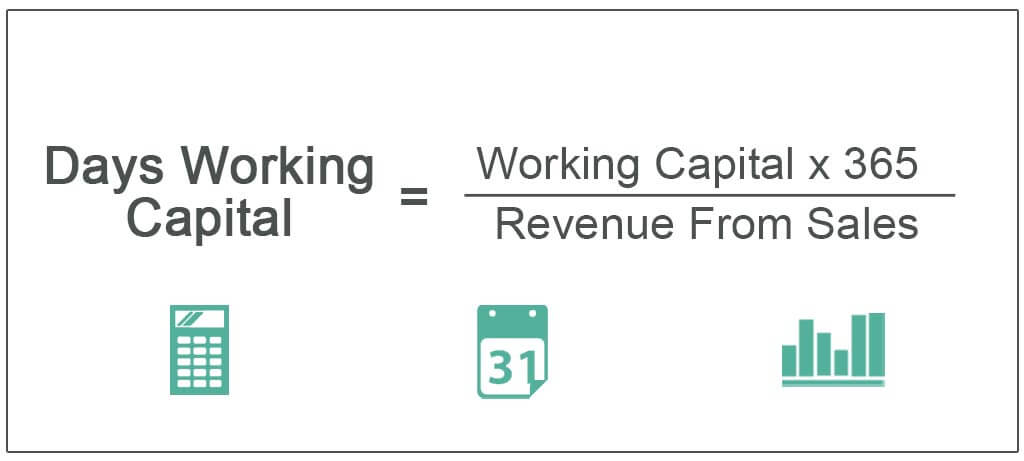

Days Working Capital Definition Formula Calculation

Return On Capital Employed Roce Formula And Calculator

Financial Kpis Metrics See The Best Finance Kpi Examples

Net Working Capital Formula Examples How To Calculate Net Working Capital Video Lesson Transcript Study Com

Net Operating Working Capital And Cash Flow Download Table

Dheeraj On Twitter Invested Capital Definition Formula How To Calculate Invested Capital Https T Co Qkjt6vspnl Investedcapital Definition Formula Https T Co Nqyhnypn09 Twitter

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Net Working Capital With Definitions And Formulas

A Complete Guide To Net Working Capital And How To Calculate It

Net Working Capital Formulas Examples And How To Improve It

Solved Quantitative Problem Bellinger Industries Is Chegg Com

Operating Working Capital Owc Financial Edge

Definition Of Variables Download Table

Pdf Working Capital Management Shajahan Kabir Manik Academia Edu

Net Working Capital Formula Definition Formula How To Calculate

Working Capital Cycle What Is It With Calculation

:max_bytes(150000):strip_icc()/WORKING-CAPITAL-FINAL-SR-16dac45bb5fb4f0cad62cd706c59e0cd.jpg)